nh business tax calculator

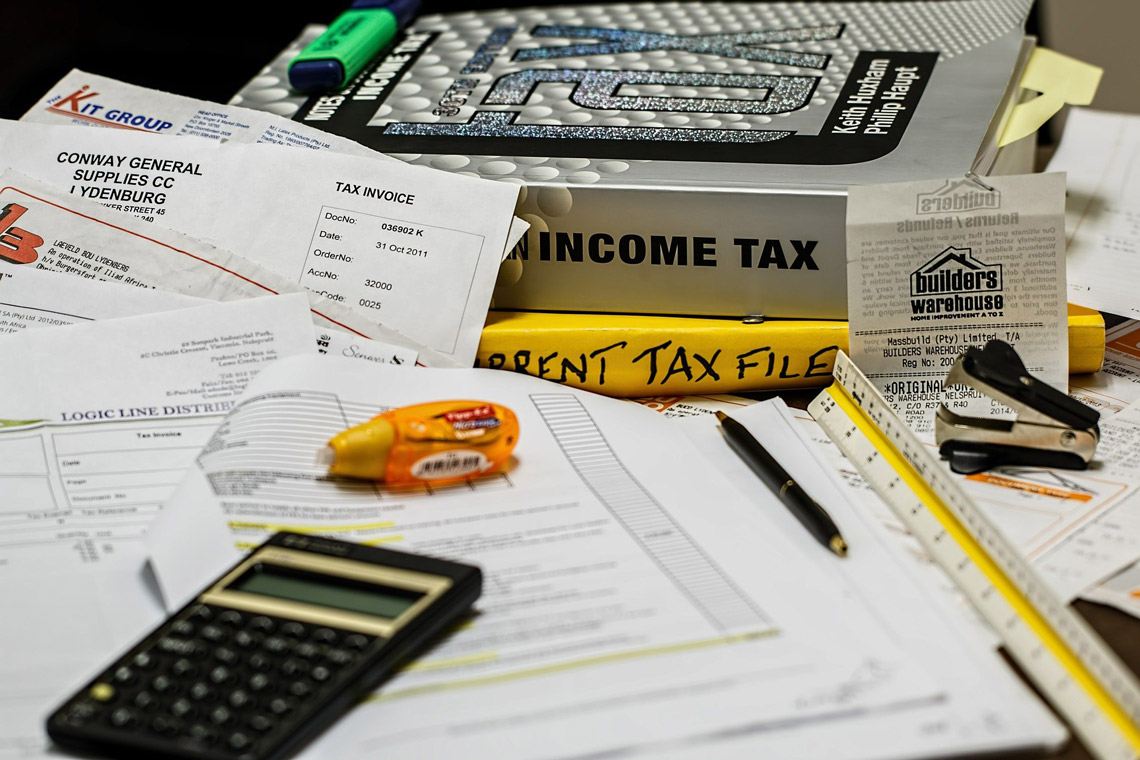

To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. Real Estate Exemptions - RSA 7223.

Business Tax Data Nh Department Of Revenue Administration

During normal business hours staff is also available to answer questions via telephone call or e.

. Southern New Hampshire University is a registered trademark in the United. Estimate your tax refund with HR Blocks free income tax calculator. Vital Records If you need a vital record ie birth certificate death certificate divorce certificate you can order by calling 1-800-255-2414 or by mailing in.

Franklin City Clerks Office 316 Central Street Franklin NH 03235. The MN Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MNS. The Minnesota tax calculator is updated for the 202223 tax year.

Pay data is updated each year. 603-934-3109 Mail To. The drop box is checked several times each day.

Prorated Assessment for Damaged Buildings - RSA 7621. The Minnesota income tax calculator is designed to provide a salary example with salary deductions made in. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year.

Small business tax prep File yourself or with a small business certified tax professional. Solar Energy Systems Exemption Applications are due April 15 2022 for the 2022 Tax Year. 2019-2021 Market Value Changes as shown by Re-Sale Properties Since 2019 the housing market in Concord continues to be very active with substantial appreciation.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. For example if the sales tax rate is 6 divide the total amount of receipts by 106. United States Tax Tables and Personal Income Tax Rates and Thresholds.

The salary comparison calculator uses the tax rates and thresholds from the Federal Tax Tables and individual State Tax Tables. Drop off payments in the secure receptacle located behind the Town Hall building at the far end of the parking lot. 316 Central Street Franklin NH 03235 603 934-3900.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report. Mail is being picked up and processed during normal business hours.

You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Each year the United States publishes new Tax Tables for the new tax year the Tax Tables are published by the Inland Revenue Service IRS. Ten years of data starting at 2009 will be available to search.

Filing A Schedule C For An Llc H R Block

What New Hampshire Has Business Taxes Appletree Business

Elegant Cpa Certified Public Accountant Business Card Zazzle Com Certified Public Accountant Accounting Cpa

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

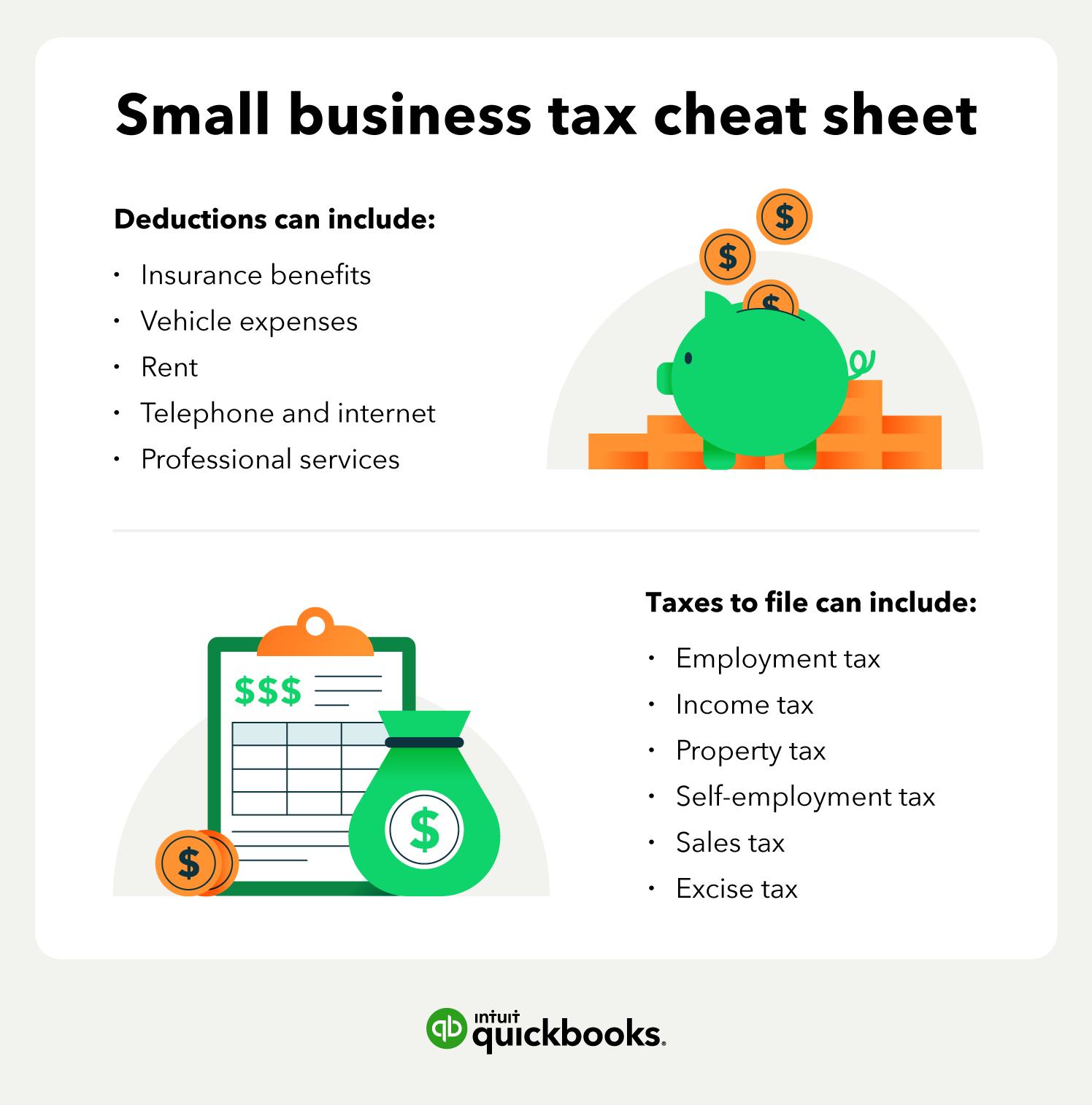

Free Llc Tax Calculator How To File Llc Taxes Embroker

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

What New Hampshire Has Business Taxes Appletree Business

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Ifta Calculator Tax Software Cool Photos Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Free Llc Tax Calculator How To File Llc Taxes Embroker

Oklahoma Sales Tax Small Business Guide Truic

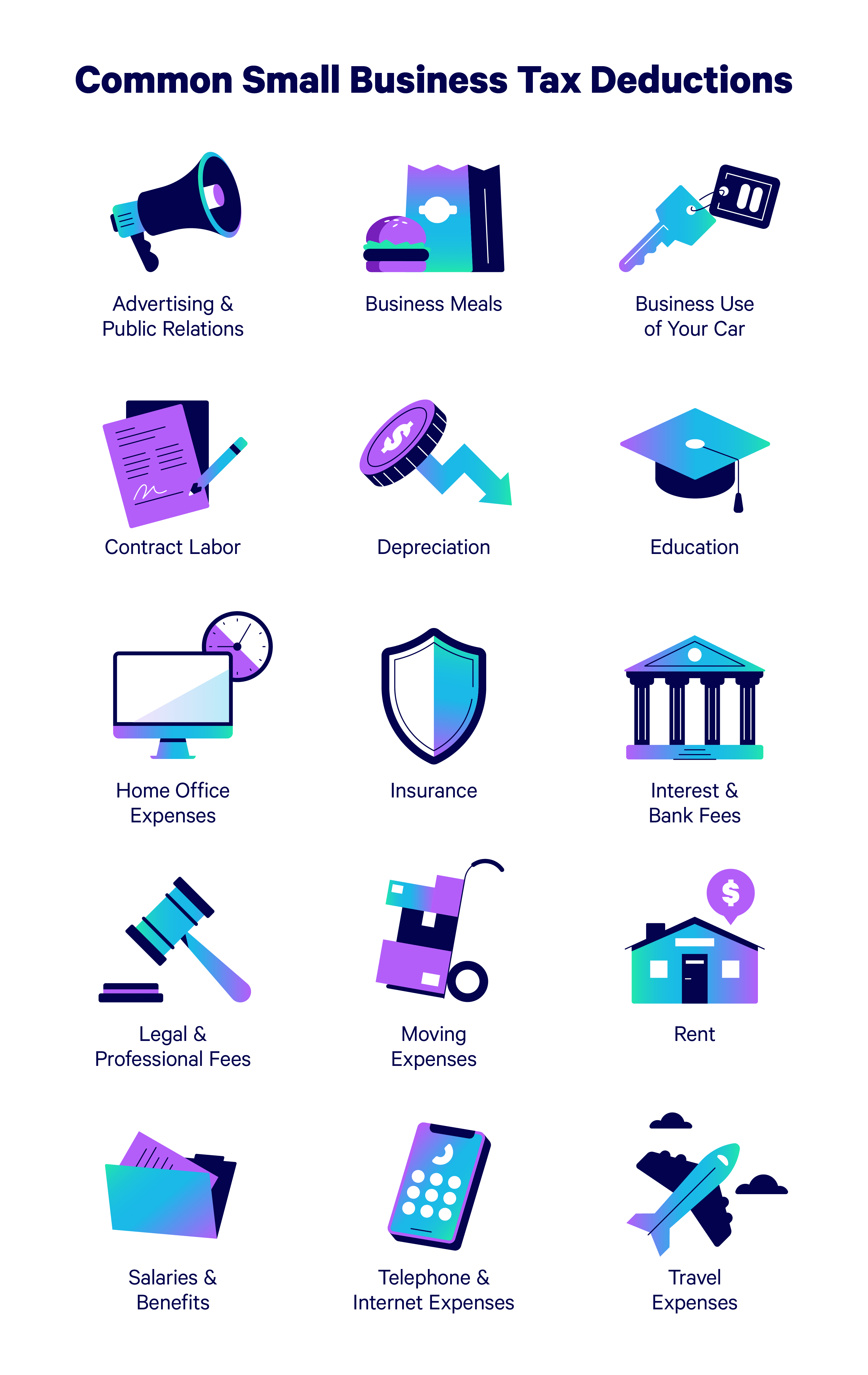

Small Business Tax Services What You Should Know Article

Llc Tax Calculator Definitive Small Business Tax Estimator

2021 Tax Breaks For Self Employed Business Vehicles Cpa Practice Advisor

How Is Tax Liability Calculated Common Tax Questions Answered

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance